BTC Price Prediction: Path to $200,000 Amid Strong Technical and Fundamental Backdrop

#BTC

- Technical indicators show Bitcoin trading above key moving averages with Bollinger Bands suggesting continued upward momentum

- Fundamental factors including record network activity and 72% illiquid supply provide strong underlying support

- Reduced market leverage and institutional adoption create favorable conditions for reaching $200,000 target

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

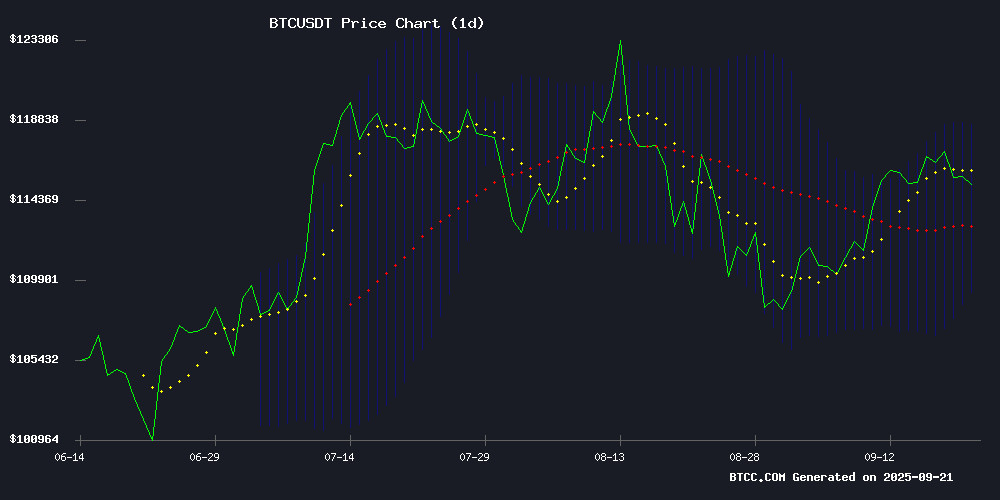

According to BTCC financial analyst James, Bitcoin's current price of $115,687 sits comfortably above its 20-day moving average of $113,930, indicating underlying strength. The MACD reading of -3,423.72 suggests some bearish momentum but the narrowing gap between MACD and signal line shows potential for reversal. The Bollinger Bands position with price NEAR the upper band at $118,665 suggests continued upward pressure, while the middle band at $113,930 provides solid support.

Market Sentiment: Strong Fundamentals Support Bitcoin's Ascent

BTCC financial analyst James notes that multiple positive developments are converging for Bitcoin. The network activity hitting 2025 peaks, long-term holders regaining profitability, and the significant illiquid supply reaching 72% all point to strong fundamental support. While Tether's mining issues in Uruguay present a minor concern, the overall sentiment remains bullish with institutional interest growing and Michael Saylor's continued advocacy adding credibility to Bitcoin's digital capital narrative.

Factors Influencing BTC's Price

Bitcoin Tests Weekly Open as $113,300 Fair Value Gap Looms

Bitcoin's price action last week was marked by volatility, closing with a marginal 0.07% loss. The cryptocurrency briefly surged to $118,000 following the US Federal Reserve's announcement of its first 2025 interest rate cut, but has since retreated to $115,700 as trading activity slowed.

Analyst KillaXBT identifies two critical support levels: the weekly open at $115,219 and a daily fair value gap at $113,355. Holding above the weekly open WOULD signal bullish strength, while a breakdown could trigger a retracement to fill the $113,355 imbalance zone—a typical market behavior after rapid price movements.

Tether's Uruguay Bitcoin Mining Operations Halted Over $5M Energy Debt

Tether's ambitious Bitcoin mining venture in Uruguay has hit a significant roadblock. The state-owned electricity provider UTE cut power to the stablecoin issuer's two mining facilities on July 25, 2025, over unpaid energy bills totaling approximately $5 million. This development comes just two years after Tether launched the project, attracted by Uruguay's abundant renewable energy resources.

Local reports indicate payment defaults began in May 2025. Despite a June Memorandum of Understanding between UTE and local operator Microfin to negotiate a settlement, arrears continued accumulating. The power suspension immediately disrupts operations, damaging computing nodes and reducing hash rate output while derailing expansion plans.

Restarting operations presents additional challenges, from contract renegotiations to technical restoration—a process that could take weeks. The setback underscores the operational risks of energy-intensive bitcoin mining, even in jurisdictions with favorable renewable energy conditions.

The Case for Bitcoin Treasury Stocks Over Direct BTC Ownership

Bitcoin's rise as a cornerstone asset has birthed an unconventional investment thesis: public companies holding BTC on their balance sheets may offer greater upside than the cryptocurrency itself. Adam Livingston, author of *The Bitcoin Age and the Great Harvest*, argues this pivot reflects a broader financial infrastructure emerging around Bitcoin's rails.

The vision hinges on a future where Bitcoin's market capitalization reaches $100-200 trillion, enabling censorship-resistant, global transactions and yield streams. Building this infrastructure—tackling custody, compliance, and cross-jurisdictional distribution—requires specialized firms. Their stocks, Livingston suggests, could eclipse BTC's returns as they construct the plumbing of this new economy.

Bitcoin Long-Term Holders Regain Profitability Edge, Signaling Potential Bull Cycle

Bitcoin's market dynamics are shifting as long-term holders (LTH) outpace short-term traders in profitability. The Spent Output Profit Ratio (SOPR) shows LTHs are regaining dominance, a historical precursor to sustained bullish phases. Analysts interpret this as early-stage accumulation, with $120,000 emerging as the next technical target.

The LTH/STH SOPR ratio's upward trajectory mirrors patterns seen in previous market cycles. When long-term investors lock in greater profits than speculators, it typically reflects stronger conviction and reduced sell pressure. Current on-chain data suggests this divergence is now underway.

Bitcoin Defies Seasonal Trends with Strong September Performance

Bitcoin has shattered its historical September slump, posting an 8% gain in 2025 while firmly holding support NEAR $116K. The cryptocurrency's resilience defies years of seasonal weakness, with technical indicators like the RSI at 57 and Parabolic SAR confirming bullish momentum.

On-chain data reveals growing conviction among investors, with the NVM Ratio dipping to 2.3 and Exchange Reserves contracting. Derivatives markets echo this sentiment, as the Long/Short Ratio reached 1.20—signaling strong belief in a breakout above $123K resistance toward $130K.

The daily chart shows BTC maintaining its ascending trendline defense, transforming what's traditionally been a month of profit-taking into a potential launchpad for new highs. Market structure suggests September 2025 may mark a paradigm shift in Bitcoin's seasonal patterns.

Bitcoin Price Could Push Towards New Highs After $2.6 Billion Buying Frenzy

Bitcoin's bullish momentum is gaining strength as investors shift from selling to accumulating, with over 23,000 BTC worth $2.67 billion moved off exchanges in the last 24 hours. This marks the highest accumulation level in nearly two months, signaling long-term holding intentions rather than short-term profit-taking.

Technical indicators reinforce the positive outlook. The squeeze momentum indicator shows a bullish release, suggesting upward price expansion is likely. Bitcoin has maintained steady gains this month, trading at $116,027, with potential to break through key resistance levels.

The market's resilience shines through broader volatility, as fundamental demand meets favorable technical conditions. Exchange outflows at this scale historically precede significant price movements, putting traders on watch for potential new highs.

Bitcoin Network Activity Hits New 2025 Peak — What This Means For Price

Bitcoin's price exhibited mixed performance this week, briefly dipping below $115,000 before rallying toward $118,000 post-Fed rate cut. The cryptocurrency now hovers near its starting point, but on-chain data signals potential upward momentum.

Network activity has surged to 2025 highs, with the 14-day SMA of Bitcoin transactions reaching 540,000. This metric, tracked by CryptoQuant analyst CryptoOnchain, reflects growing fundamental demand and usage. Protocols like Bitcoin Ordinals may be amplifying this activity.

Historically, such transaction spikes precede price appreciation. The current network vitality suggests accumulating bullish pressure, though market participants await confirmation through sustained breakout above key resistance levels.

Fed Cut Wipes Out Leverage as Bitcoin Supply Ratio Drops

Bitcoin's exchange supply ratio on Binance has fallen to 0.029, signaling a reduction in coins available for immediate trading. This decline coincides with the Federal Reserve's recent rate decision, which has injected volatility across global markets. Analysts interpret the drop as a strategic MOVE by holders to reduce exposure during periods of heightened sensitivity.

Perpetual futures open interest saw a sharp decline from 395,000 BTC to 378,000 BTC, as Leveraged positions were liquidated amid market turbulence. Despite this flush, Bitcoin continues to consolidate near yearly highs, with $116,700 and $113,000 emerging as critical technical levels.

The MOVE metric suggests a broader trend of coins moving off exchanges, potentially reflecting long-term accumulation strategies. Market observers note this development occurs as Bitcoin tests resistance near $117,000 before experiencing slight pullbacks.

Total Illiquid Bitcoin Has Reached 72% Of Supply, What Does This Mean For Price?

Bitcoin's illiquid supply has surged to a record 14.3 million BTC, representing over 72% of its circulating supply. These coins, held by long-term investors with a seven-year dormancy threshold, signal reduced selling pressure and potential supply shock dynamics.

Fidelity's research underscores the bullish implications: shrinking exchange reserves and institutional accumulation created the conditions for Bitcoin's recent all-time high above $124,000. The asset manager identifies two primary holders of illiquid BTC—vintage wallets inactive since 2017 and corporate treasuries maintaining 1,000+ BTC positions.

Michael Saylor Champions Bitcoin as 'Digital Capital' with Long-Term Outperformance Claims

MicroStrategy's unwavering Bitcoin bet continues to dominate discussions about the cryptocurrency's role in modern finance. The company now holds over 638,500 BTC—a position CEO Michael Saylor values at "tens of billions"—solidifying its identity as a corporate Bitcoin standard-bearer since 2020.

In a recent Coin Stories interview, Saylor made his boldest prediction yet: Bitcoin will perpetually outpace the S&P 500, projecting the index would lose 29% annually against BTC for two decades. He cites Bitcoin's decade-long performance as evidence of this growing divergence.

The executive framed Bitcoin as revolutionary collateral, calling it "digital capital" for loan backing and credit instruments. Its fixed supply and decentralized nature, he argues, create more stability than fiat currencies in long-term economic scenarios.

Bitcoin VWAP Bands Signal Strong Support Amid Futures Market Pressure

Bitcoin's price volatility has intensified, yet the Volume-Weighted Average Price (VWAP) bands reveal underlying strength. The 14-day VWAP level near $114.5K is absorbing selling pressure, acting as dynamic support. Axel Adler Jr., a prominent crypto analyst, notes this resilience contrasts sharply with the Futures Pressure Index hitting bearish extremes at 32.5.

Market structure favors bulls, with BTC's price holding in the upper half of VWAP bands. The +1σ and +2σ levels now serve as resistance markers, while -1σ and -2σ provide robust support floors. This technical setup suggests institutional accumulation continues despite derivatives market pessimism.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, BTCC financial analyst James believes Bitcoin has a strong probability of reaching $200,000. The combination of technical strength above key moving averages, reduced leverage in the market, and fundamental factors such as increased network activity and institutional adoption creates favorable conditions. However, this target would likely require sustained bullish momentum over several months.

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $115,687 vs $113,930 | Price above MA |

| Bollinger Position | Near upper band | Upward momentum |

| Illiquid Supply | 72% | Reduced selling pressure |

| Network Activity | 2025 peak | Growing adoption |